Buyer Demand Remains Resilient

Forecasts Revisited

Hello again, now we’ve reached August, and we’re back with a brand-new market update. This time around we have data from the whole first half of the year, which allows some useful insights into how well the market forecasts from the end of 2021 are doing right about now.

Let’s get right into it:

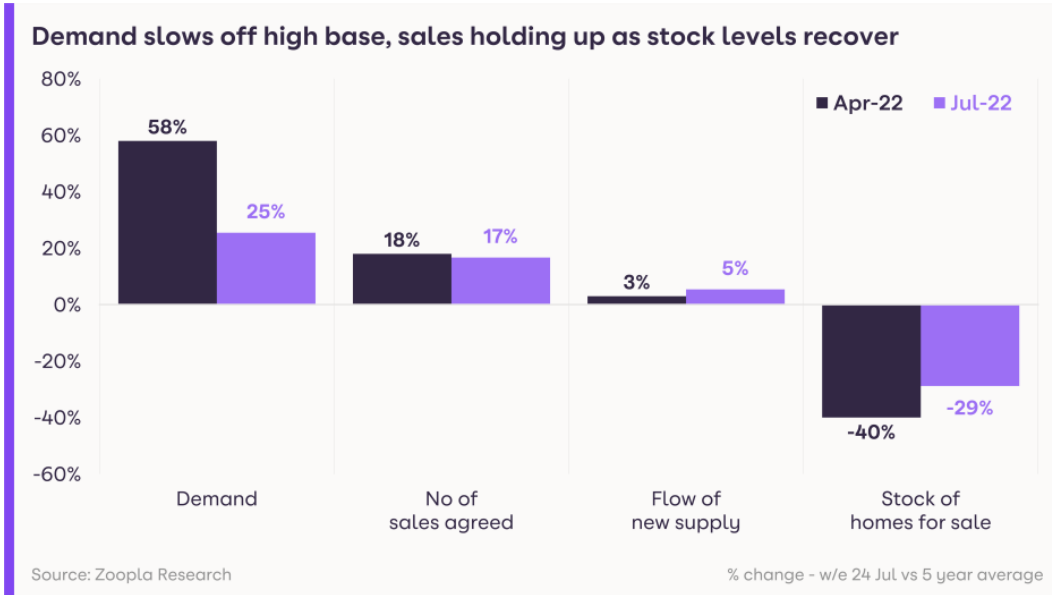

The rate at which house price growth would diminish is slower than what was expected. It was predicted that economic uncertainty brought about by rampant inflation and the cost-of-living crisis would prove a significant stopper to buyer demand. And lowering demand has now meant that the rate of house price growth is falling. But not by much. Compared to the last market report’s 8.4% growth, this month’s house price growth at the end of H1 is reported to be 8.3%.

This .1% fall means that house price growth falling to between 2-4% as projected in December is no longer feasible. Zoopla has now amended this projection to a +5% average by the end of the year.

The projected number of transactions for 2022 has also been raised by 100,000, jumping from 1.2 million to 1.3 million.

Affordability has not been as much of a restriction for demand, but it is still expected to play a greater effect in Q3 and Q4.

Resilient Demand

The resilience of buyer demand has been attributed to ongoing changes in thinking brought about by the pandemic. Chiefly, this is a result of increased flexibility in the workplace. People who expect to work from home more in the future are reportedly five times more likely to be looking to move than people whose schedules are expected to stay as they were pre-pandemic.

To contextualise this, the pandemic has more than doubled the number of workers who work from home.

Supply has even begun to recover, rising from -40% (compared to 5-year averages) to -29% from the last market report.

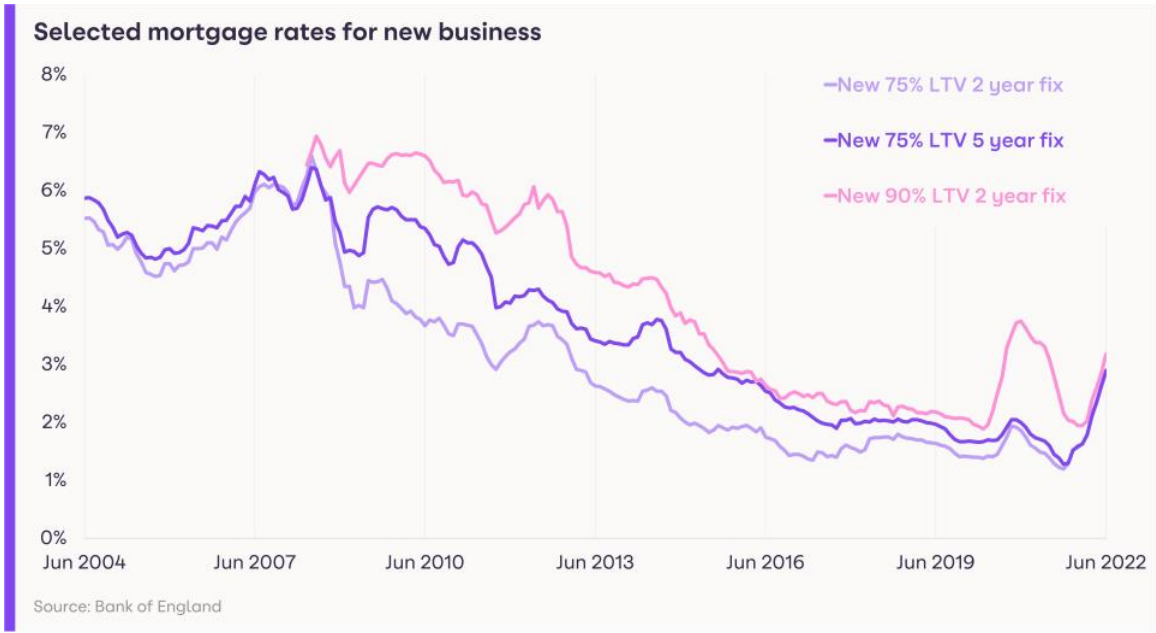

All in all, major price falls are unlikely any time soon. The market has been protected from over-valuation by post-economic-crisis regulations and even with rising mortgage rates, house price growth is expected to only reach 0 at a 4% average mortgage rate. It is currently 3.5%.

If price falls do occur, they will be moderated and not the crash that some may expect.

But of course, this does not mean that taking action early and securing lower mortgage rates before they rise is no longer a worthwhile strategy for buyers. When demand falls, it will swing into a buyer’s market, so equally for vendors, listing their homes sooner rather than later may be best.

Of course, general trends can only go so far, and everyone has individual needs which are best served by a bespoke solution. So, if you would like to discuss your property plans, you can find our contact information Here.

And until the next market update, have a fantastic month.

Luiz De Souza | Administrator