Slowing Price Growth and Rising Rates

Growth Begins to Slow

Another month has passed by, and the many changes come with it. Outside of the pressing political machinations that took place on the 7th of July, the latest data suggests that the property market is starting to feel the effects of the economic headwinds that 2022 has brought along with it.

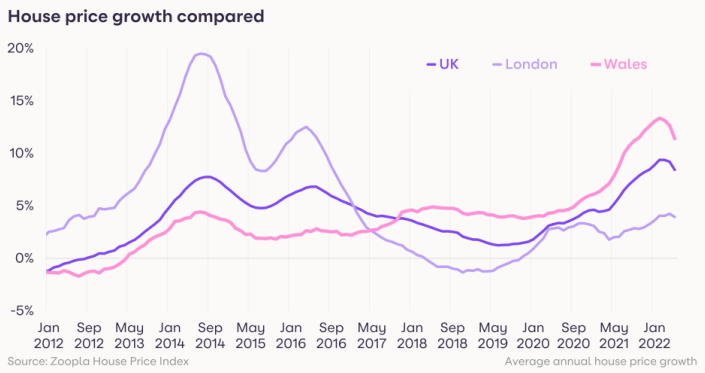

The robust price growth that has endured in the past two years has now begun to demonstrable signs of slow-down. Last month, we spoke of house price growth on average sitting at +8.4%. This figure remains the same this time around. This means we have passed the peak of the curve, and the next market update will see house price growth on a downward trajectory.

With only half the year left, this would mean house price growth would have to fall by an average of 0.9% a month to reach the +3% growth projected for the end of the year. This is a fairly steep decline compared to the rate of growth over the past few months, but it is supported by rising interest rates and lower buyer demand.

Explaining Waning Demand

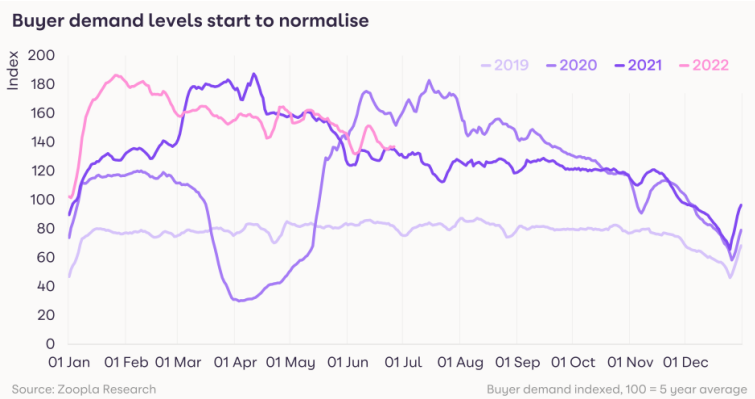

Demand was up 61% compared to a five-year average on our last report. This now sits at +40%. The over 10% dip can be accounted for by considering price sensitivity in buyers.

For example, mortgage rates in December 2021 (for a 5-year fixed-rate loan – according to Moneyfacts) were 2.64%. This has now risen to 3.37%. To put this in context, the average annual cost of a loan for an average-priced home (£250,000) with a 25% deposit for a 25-year term has increased by £870. With a standard 10% deposit, this increase would be closer to £1,030. Mix this in with a cost-of-living crisis, brought about by inflation and raised taxes, then it can easily explain the softening demand.

Now that’s quite a few numbers. What it essentially means is that affordability for buyers will become increasingly tough in the next few months. This, considering the slowing flow of stock (down to +4% from +7%) and low overall stock (-33% vs. 5-year averages), means the time to buy is now.

If you would like to discuss your property plans in response to the changing market contact us HERE.

And until the next market update, have a fantastic month.

Luiz De Souza | Administrator